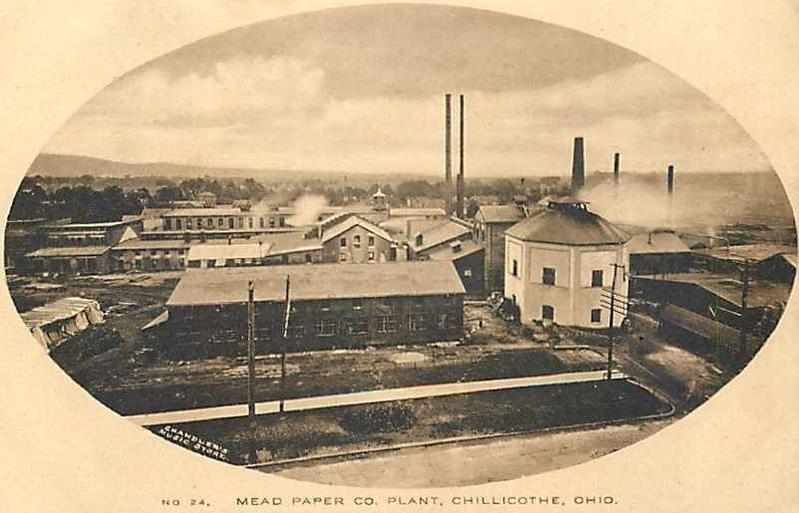

Twelve years after the centennial of the purchase of the Chillicothe mill by what became Dayton’s Mead Corporation, the facility bounced between paper companies and investment corporations for 13 years…until declared doomed in 2025.

To understand the situation a little better, here is my summary compilation of that time period…mostly in quotes from Wikipedia.*

Find my news stories on the Scioto Post for current responses to the threat of closure. For snippets of earlier newspaper, magazine, photographic, and cartographic history of the mill – explore all of my Facebook posts.

Mead Becomes MeadWestvaco in 2002, Sells Chillicothe Mill in 2005 (and Merges Away in 2015)

https://en.wikipedia.org/wiki/MeadWestvaco

MeadWestvaco Corporation was an American packaging company based in Richmond, Virginia. It had approximately 23,000 employees…

MeadWestvaco was a producer of packaging, specialty papers, consumer and office products and specialty chemicals. The company had 153 operating and office locations in 30 countries, and served customers in over 100 countries…

MeadWestvaco was formed in January 2002 as the result of a merger between The Mead Corporation of Dayton, Ohio, and Westvaco [originally the West Virginia Paper Company]…

In 2005, the Papers business unit—including both Mead and Westvaco paper mills—was sold to the investment firm Cerberus Capital Management for about $2.3 billion. The new company was called NewPage Corporation…

(In 2012, ACCO Brands acquired [the “Mead” brand and currently markets its products, such as Trapper Keeper and Mead notebooks].)

[The Kingsport Pulp Corporation in Kingsport, Tennessee eventually became the RockTenn Company.] MeadWestvaco announced in January 2015 that it would form a combined $16 billion company with RockTenn to take on market leaders in the packaging industry in the U.S.

The combined company is named WestRock [and MeadWestvaco became defunct].

In 2005, MeadWestvaco Sold to Cerberus Capital (which Creates “NewPage”)

https://en.wikipedia.org/wiki/Cerberus_Capital_Management

Cerberus Capital Management, L.P. is an American global alternative investment firm with assets across credit, private equity, and real estate strategies.

The firm is based in New York City, and run by Steve Feinberg, who co-founded Cerberus in 1992…

Cerberus is named after the Greek mythological three-headed dog that guarded the gates of Tartarus. Feinberg has stated that while the Cerberus name seemed like a good idea at the time, he later regretted naming the company after the mythological dog…

The company acquired MeadWestvaco’s paper business for $2.3B in 2005 and renamed it NewPage.

NewPage Sells Chillicothe Mill to Glatfelter in 2006 (then Merges Away in 2015)

https://en.wikipedia.org/wiki/NewPage

NewPage was a leading producer of printing and specialty papers in North America with $3.1 billion in net sales for…2012.

NewPage was headquartered in Miamisburg [Dayton?], Ohio, and owned paper mills in Kentucky, Maine, Maryland, Michigan, Minnesota and Wisconsin. These mills have a total annual production capacity of approximately 3.5 million tons of paper.

In 2005, MeadWestvaco’s Printing and Writing Paper business was sold to investment firm Cerberus Capital Management for about $2.3 billion to form NewPage Corporation. NewPage originally constituted five pulp and paper manufacturing plants in Kentucky, Maine, Maryland, Michigan, and Ohio.

In April 2006, NewPage sold their carbonless operations located in Ohio [including the Chillicothe Mill] for $84 million to global specialty papermaker P. H. Glatfelter Company, based in York, Pennsylvania.

…On September 7, 2011, the NewPage Corporation filed for chapter 11 bankruptcy reorganization due to negative cash flow for more than a year. NewPage Corporation announced December 21, 2012, that it has successfully completed its financial restructuring and has officially emerged from Chapter 11 bankruptcy protection…

In early 2015, NewPage was acquired by the Verso Corporation for $1.4 billion [and NewPage became defunct].

Glatfelter Buys Chillicothe Mill in 2006, then Sells to Lindsay Goldberg in 2018…then Glatfelter Merges Out of Existence in 2024

https://en.wikipedia.org/wiki/Glatfelter

The company was started by Philip Henry Glatfelter in 1864 in Spring Grove, Pennsylvania…

In August 2018, Glatfelter announced an agreement to sell its Specialty Papers division [including the Chillicothe mill] to private investment firm Lindsay Goldberg for $360 million, with the sale to close before 2019. This formed a new privately held company, Pixelle Specialty Solutions.

…[In] 2024, Glatfelter merged with Berry Global’s Health, Hygiene and Specialties Global Nonwovens and Films business (the “HHNF Business”), forming Magnera Corporation, the largest nonwovens company in the world…

The company’s products are found in tea and single-serve coffee filtration, personal hygiene and packaging products, as well as home improvement and industrial applications. Headquartered in Charlotte, North Carolina…

Lindsay Goldberg Creates “Pixelle Specialty Solutions” in 2018

https://en.wikipedia.org/wiki/Lindsay_Goldberg

Lindsay Goldberg (LGLLC) is an American private equity firm focused on leveraged buyout and growth capital investments in middle-market companies in such sectors as consumer products, commodity-based manufacturing, energy services, business services, healthcare, financial services, energy transmission and waste disposal.

[no Wikiedia entry on Pixelle, so…seeking an unbiased description:]

Pixelle Specialty Solutions became the largest specialty papers producer in North America

PapNews, Feb 11, 2020

Pixelle Specialty Solutions has completed its acquisition of specialty papers mills in Jay, ME and Stevens Point, WI from Verso Corporation.

With the addition of the newly acquired mills, Pixelle is now the largest specialty papers producer in North America with production currently exceeding one million tons annually.

Pixelle has industry-leading positions in multiple specialty paper grades including release papers, thermal labels, food and beverage labels, food packaging papers, inkjet papers, casting liners, book papers, carbonless and forms, security papers, envelope and converting papers, and various niche products…

Pixelle now operates a four-mill specialty paper system: Jay, ME; Chillicothe, OH; Spring Grove, PA; and Stevens Point, WI. Three have on-site pulp mills. Collectively the mills deploy 12 paper machines and produce more than one million tons of paper annually.

In addition, Pixelle operates a converting facility in Fremont, OH and strategically located wood sourcing operations committed to sustainable forestry throughout its operating regions.

Pixelle was formed in 2018 by Lindsay Goldberg, a private investment firm that focuses on partnering with families, founders, and management teams seeking to actively build their businesses…

Pixelle Specialty Solutions is Bought by H.I.G. Capital in 2022…which Announces Chillicothe Mill Closure in 2025…

https://en.wikipedia.org/wiki/H.I.G._Capital

H.I.G. Capital, LLC is a global alternative investment firm with $69 billion of capital under management. Headquartered in Miami, Florida, H.I.G. specializes in providing both debt and equity capital to middle market companies.

According to the firm’s website, H.I.G. has invested in and managed more than 400 companies since inception. The firm’s current portfolio includes more than 100 companies with combined sales in excess of $53 billion.

H.I.G. currently has over 1,000 total employees, including more than 500 investment professionals worldwide.

H.I.G. Capital was founded in 1993 by Sami Mnaymneh and Tony Tamer, both of whom previously held senior positions at The Blackstone Group and Bain & Company. “The company remains under their directorship.”

…H.I.G.’s real estate funds invest in value-added properties, which can benefit from improved asset management practices. Its Infrastructure funds focus on making value-add and core plus investments in the infrastructure sector.

…The company is headquartered in Miami and has affiliate offices in several major cities across the United States, including New York City, Boston, Chicago, Dallas, Los Angeles, San Francisco, and Atlanta. Additionally, the firm has international offices located in London, Hamburg, Madrid, Milan, Paris, Luxembourg, Bogotá, Rio de Janeiro, São Paulo, Dubai, and Hong Kong.

* Not as bad as you might think. Wikipedia’s political entries tend to be sabotaged, but not other topics – so it’s a decent start for research and understanding…plus, I have been meaning to get credentials there to make corrections and additions to local history as needed.

– end –